One of the things many of us do not like about going digital is remembering the passwords of each and every account. Right from social media accounts to the important ones like our Net banking and income tax return (ITR) filing accounts, they all come with passwords to log in. Remembering a password of an account which we don’t use regularly is even more difficult.

This is what happens to many of us when it comes to our ITR filing password. A tax payer would log in to the income tax department’s e-filing website to file his/her income tax return or download Form 26AS, and that too most of us log-in just once a year.

So, if you, too, have forgotten your password, here are four ways you can reset it:

1. Answer Secret Question

2. Upload Digital Signature Certificate (DSC)

3. Using OTP

4. Using Aadhaar OTP

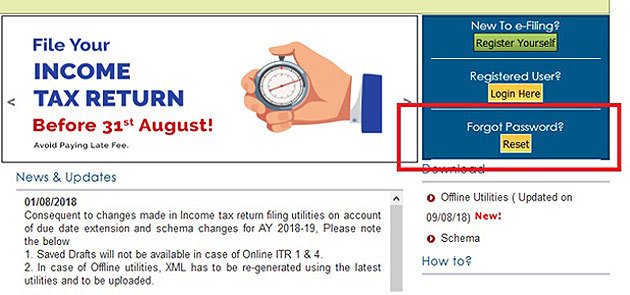

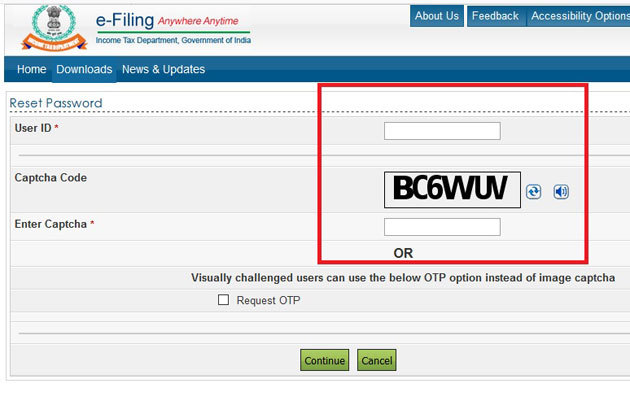

On the I-T department’s e-filing website, click on the “Forgot Password” tab on the right-hand side. You will be redirected to a new page. Here you will be required to enter user ID, i.e., your PAN and captcha. After this, you will have to click on the continue button.

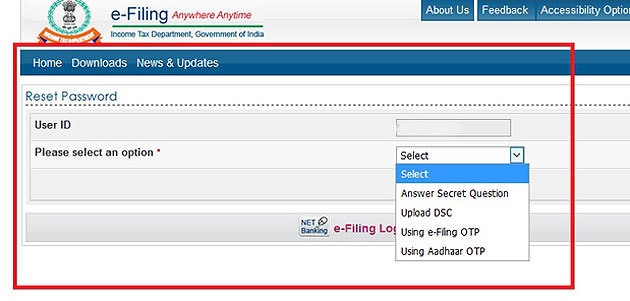

You will then have to select one of the four options as mentioned above from the drop down menu to reset your password. Follow the steps below as per the option selected by you.

1. Answer the secret question

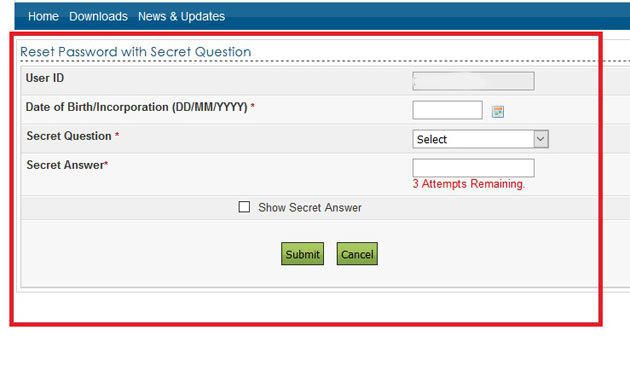

At the time of registration, the e-filing website asks the taxpayer to select two secret questions and mention their answers which will be used in case you forget your password.

If you wish to reset your password using ‘Answer the secret question’ option, select the same from the drop down menu and click on continue. The new webpage will require you to enter your date of birth and select one question from the drop down menu. Enter the answer to that question and click on submit.

If you have answered the question correctly, the website will ask you to enter new password. Enter the new password, confirm it, and click on submit. You will get a message on your screen once the password is reset.

2. Upload Digital Signature Certificate

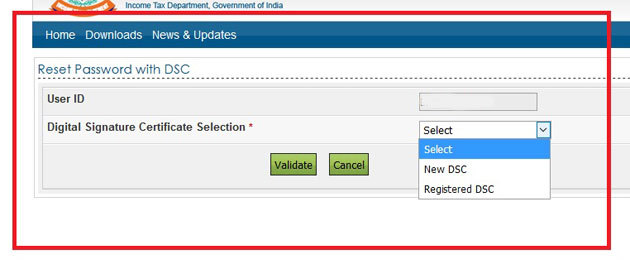

Second option to reset your password is by uploading your Digital Signature Certificate on the e-filing website of income tax department. You should have your DSC ready (i.e., generated beforehand) before starting this process. Then, from the drop down menu, select ‘Upload Digital Signature Certificate’ option. Again from the drop down menu, you have to select one of the following options:

a) New Digital Signature Certificate

b) Registered Digital Signature Certificate

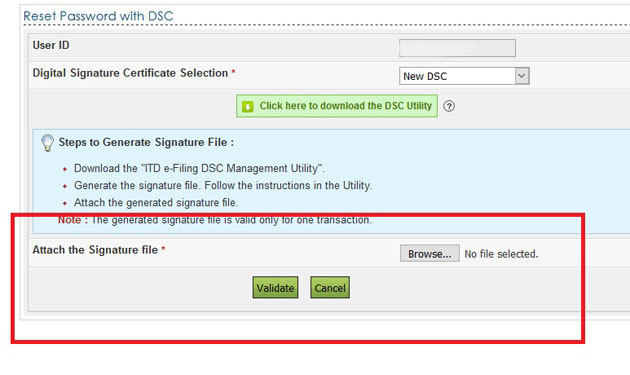

New Digital Signature Certificate will be used if you are using digital signature option for the first time. If you are already a registered user, then select option (b).

Attach the file generated by you and click on validate. Once Digital Signature Certificate is validated, you have to enter the new password and confirm it. Click on Submit. You

will get a message on your screen once the password is reset.

3. Using One Time Password (OTP)

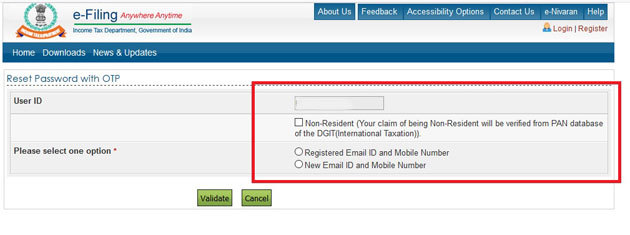

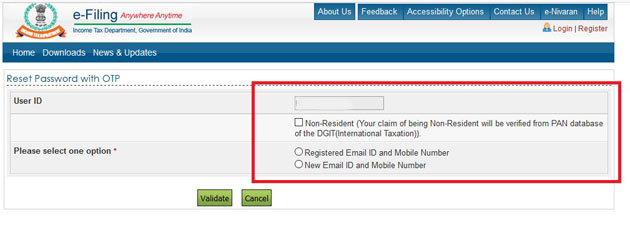

If you don’t remember the answers to the secret questions and don’t want to change password using Digital Signature Certificate, then a third alternative for is to use an OTP. From the drop down menu, select ‘Using e-filing OTP’ and click on continue.

If you are a non-resident individual (NRI), you will be required to select a tick box as your claim of being NRI will be verified from PAN database. Select one of the options below to receive the OTP:

a) Registered Email ID and Mobile Number

b) New Email ID & Mobile Number

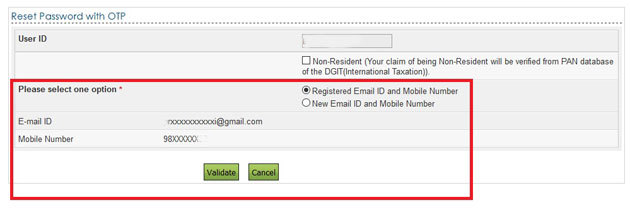

- For Registered Email ID and mobile number

If you have selected this option, your existing email ID and mobile number will be partially visible on your screen. If the details according to you are correct, you will be required to validate them.

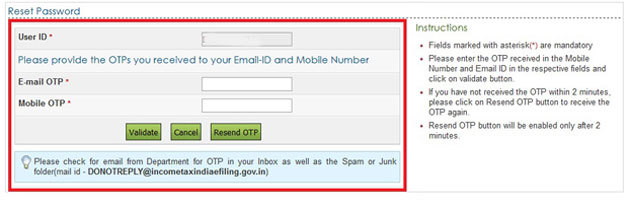

After clicking the validate button, you will receive two different OTPs on your email address and mobile number. Enter the OTPs in the required fields and click on validate. Once the OTPs are successfully validated, enter the new password and confirm it.

After clicking on submit button, you will get a message on your screen once the password is reset. You can login with new password after the time displayed on the screen. Usually it is after 12 hours.

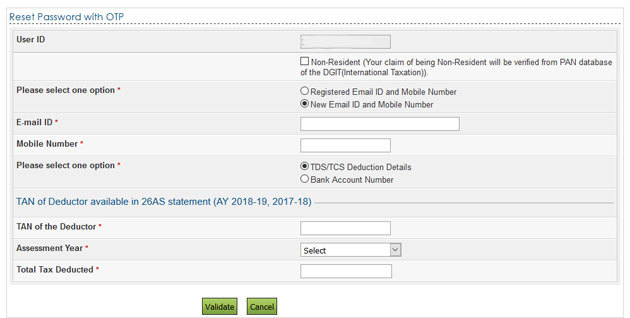

- For New Email ID and mobile number

If you wish to receive OTPs on a different email ID and mobile, you will be asked to enter the new email id and mobile number in the required fields. For security purposes, you will be required to select one of the options:

a) TDS/TCS deduction details

b) Bank Account Number

If you have selected option (a) – TDS/TCS deduction details, then you will be required to mention TAN of the deductor, assessment year and total tax deducted by the deductor. You can get this information either from your Form 26AS or Form 16 (given by your employer).

If you have selected option (b) – Bank Account, enter the bank account as mentioned by you in your previous year ITR. You can cross check this information from the previous year ITR form. Chartered accountants recommend mentioning the details of the bank which is specified by you for receiving income tax refund in the previous year’s ITR.

Once any of the above details is validated, two different OTPs will be sent on your new mobile number and email ID. Enter those OTPs in the required fields and click on validate. You will be asked to enter the new password and confirm it. Click on submit and successful message will be displayed for change of password. You can login with new password after the specified time which is usually 12 hours.

For security purposes, an email will be sent on your registered and new email id with the subject ‘Cancellation for the password reset request’. In case the password reset was not authorised by you, then click on the link mentioned in the email to cancel the request. The link is valid for 12 hours. You will be required to validate your PAN and date of birth while cancelling the password reset request.

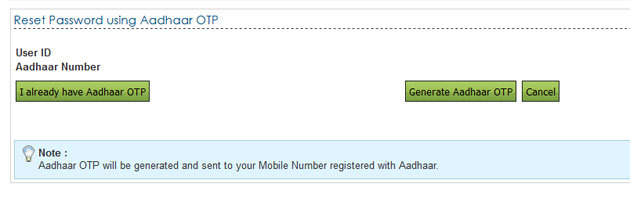

4. Using Aadhaar OTP

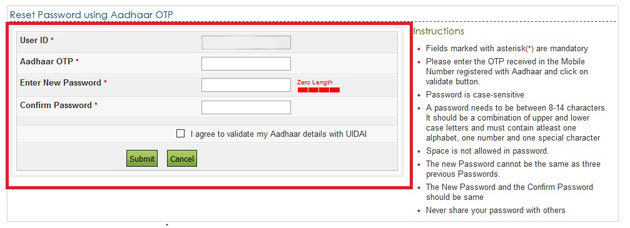

You can use this option if you fulfil two conditions: Your mobile number must be linked to Aadhaar; and your Aadhaar is already linked to your PAN.

From the drop down menu select ‘Using Aadhaar OTP’ option. Enter the Aadhaar number in the required field and click on ‘Generate OTP option’.

An OTP will be sent via SMS to your mobile number. Enter the OTP in the required field and click on validate. On successful validation, you will be asked to enter your new password and confirm it. After successful submission of your new password, you can login to your account on the e-filing website.

Source – https://economictimes.indiatimes.com/wealth/personal-finance-news/how-to-reset-password-on-income-tax-e-filing-website/articleshow/65385760.cms